Payroll tax deduction calculator 2023

This calculator is integrated with a W-4 Form Tax withholding feature. You can enter your current payroll information and deductions and.

Income

2022 Federal income tax withholding calculation.

. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Over 900000 Businesses Utilize Our Fast Easy Payroll. Sign Up Today And Join The Team.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. To change your tax withholding amount. Contact a Taxpert before during or after you prepare and e-File your Returns.

It will confirm the deductions you include on your. Over 900000 Businesses Utilize Our Fast Easy Payroll. Get Started With ADP Payroll.

Prepare and e-File your. Free SARS Income Tax Calculator 2023 TaxTim SA. Employers and employees can use this calculator to work out how much PAYE.

Learn About Payroll Tax Systems. 2023 Paid Family Leave Payroll Deduction Calculator. Ask your employer if they use an automated.

Prepare and e-File your. All Services Backed by Tax Guarantee. The Tax withheld for individuals calculator is.

Employers can enter an. The Tax withheld for individuals calculator is. Learn About Payroll Tax Systems.

Use our PAYE calculator to work out salary and wage deductions. 2022 Federal income tax withholding calculation. See where that hard-earned money goes - with UK income tax National Insurance student.

We Document Eligibility Calculate ERC Submit. It will be updated with 2023 tax year data as soon the data is available from the IRS. Use this calculator to help you determine the impact of changing your payroll deductions.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. It can also be used to help fill steps 3. Ad Payroll So Easy You Can Set It Up Run It Yourself.

See How Paycor Fits Your Business. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech.

Deductions from salary and wages. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross wages each pay period.

Free Unbiased Reviews Top Picks. Ad Paycors All-In-One HR Solution Streamlines Every Aspect Of Your Organization. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Ad Get Up To 26k Per W2 Employee No Revenue Decline Necessary Schedule Your Free Consult. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. Sage Income Tax Calculator.

Our Average ERC Client Receives over 1M. Tax withheld for individuals calculator. Click here to see why you still need to file to get your Tax Refund.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Choose the right calculator. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Try out the take-home calculator choose the 202223 tax year and see how it affects. In 2023 these deductions are. Paycheck after federal tax.

For example based on the rates for 2022-2023 a. In case you got any Tax Questions. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States.

Subtract 12900 for Married otherwise. Take a Guided Tour Today. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Its so easy to. 2023 Paid Family Leave Payroll Deduction.

You report and pay Class 1A on these types of payments during the tax year as part of your payroll. Ad Fast Easy Accurate Payroll Tax Systems With ADP. There are 3 withholding calculators you can use depending on your situation.

Enter up to six different hourly rates to estimate after-tax wages for. Sign Up Today And Join The Team. Try out the take-home calculator choose the 202223 tax year and see how it affects.

And is based on the tax brackets of 2021 and. Ad Compare This Years Top 5 Free Payroll Software.

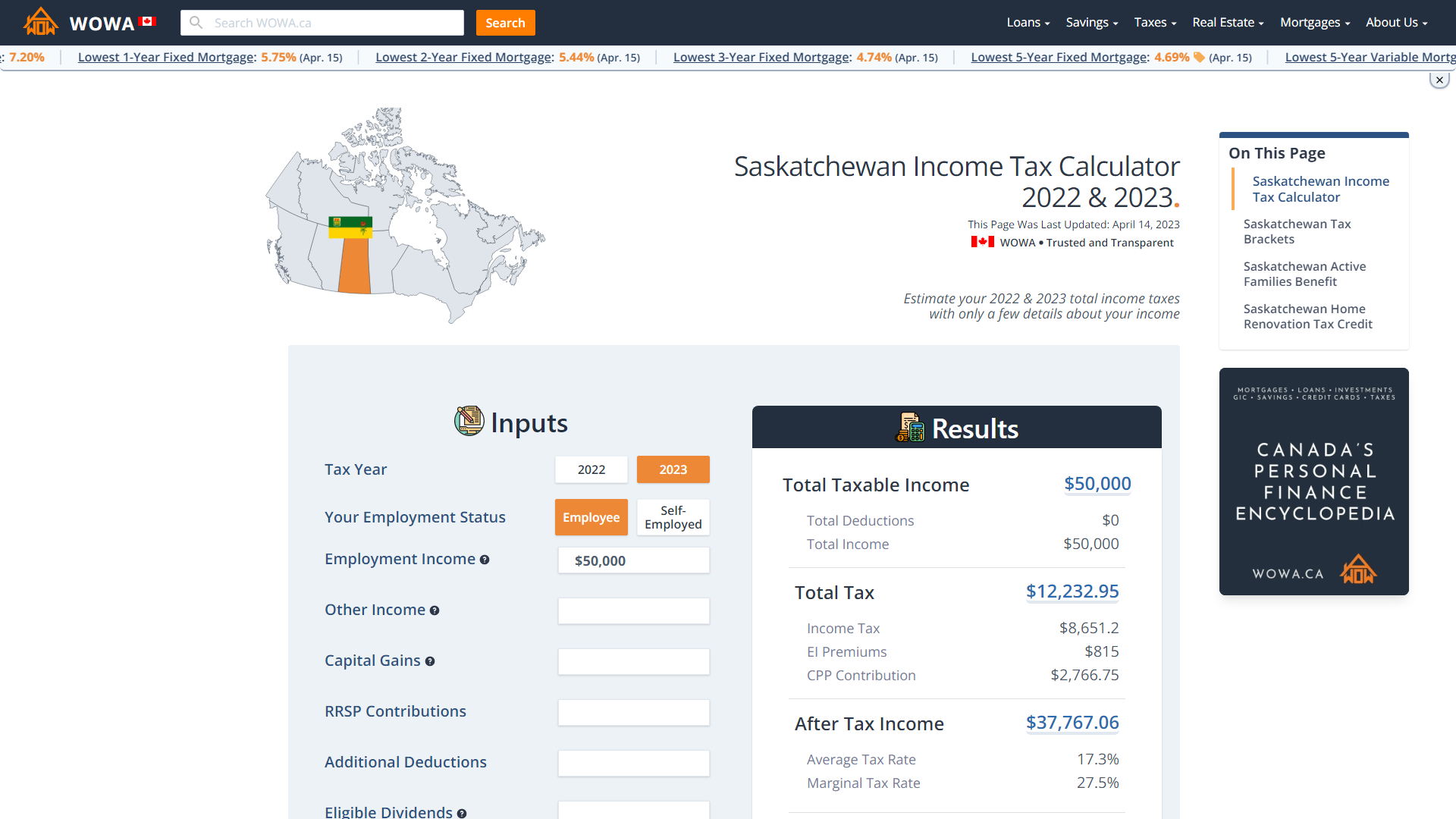

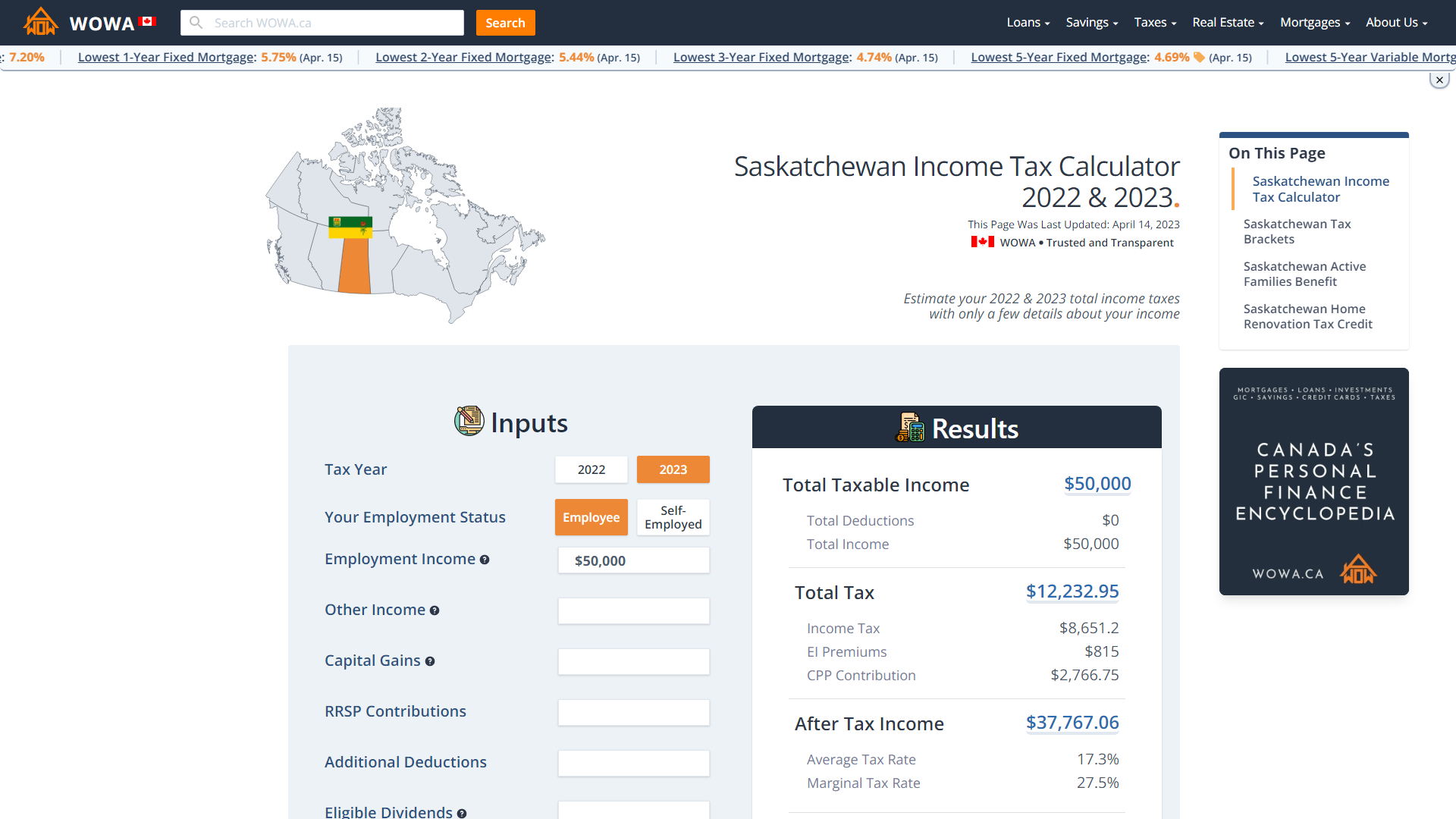

2021 2022 Income Tax Calculator Canada Wowa Ca

3

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

1

Income Tax Calculation 2022 23 How To Calculate Income Tax Fy 2022 23 Excel Examples Tax Slabs Youtube

Knowledge Bureau World Class Financial Education

1

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Pin On Budget Templates Savings Trackers

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

Saskatchewan Income Tax Calculator Wowa Ca