56+ do you need mortgage insurance and homeowners insurance

Web You need homeowners property and liability insurance even after your mortgage is paid off if you want protection for your home. However and this is a pretty big however most mortgage lenders will require some basic form of homeowners insurance.

Mortgage Insurance Vs Home Insurance What S The Difference Bankrate

Buying a home sure is excitingbut it can also be confusing.

. Web Homeowners insurance is financial protection for you and your home in the event of property damage or an accident while mortgage insurance protects your lender if you fail to pay your mortgage. Web While you may be required to purchase homeowners insurance you can usually avoid mortgage insurance if you put down 20 or more of the propertys appraised value. If you put less than 20 down your lender may require you to pay mortgage insurance.

Web The minimum the bank will accept in terms of homeowners insurance is very very rarely equal to the amount of insurance coverage you should actually have. Coverage ranges from 50 to 70 of dwellings. And thats because one it is about the value or the remaining balance on your mortgage.

Mortgage insurance protects lenders in the event that you fail to make mortgage payments. No homeowners insurance fire. Insurance maintenance requirements are different.

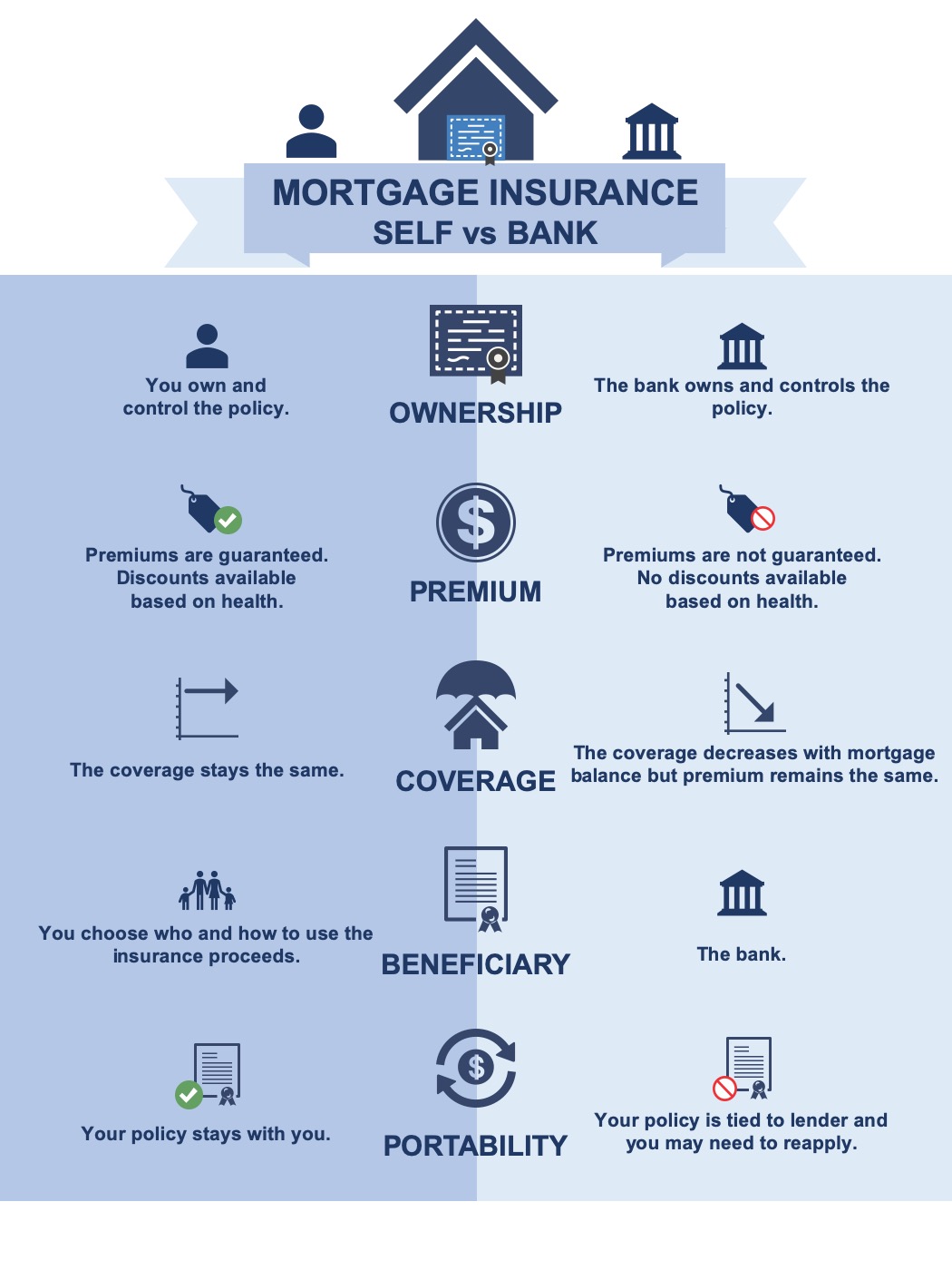

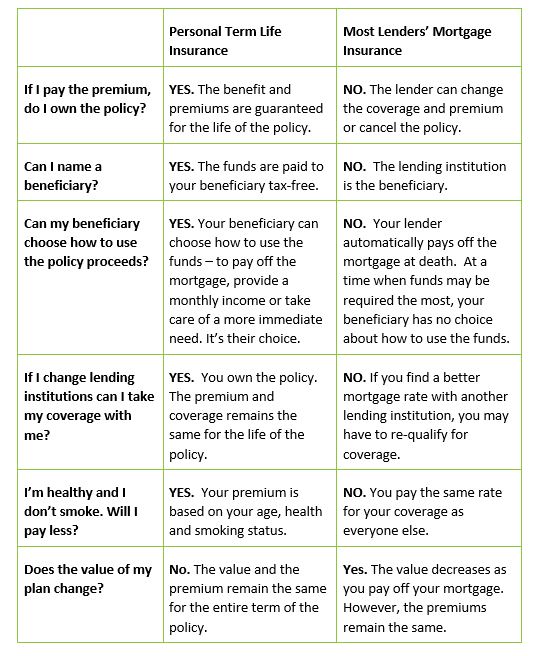

Web Private mortgage insurance or PMI is an insurance policy that you might have to pay for if you take out a conventional mortgage loan and your down payment amount is less than 20. Mortgage insurance also called PMI is paid for by the homeowner but protects the lender in case the homeowner defaults on mortgage payments. Homeowners insurance covers your home from expensive financial losses like fires and storms.

Can you insure a home you dont own. Is home insurance compulsory. Insurance on a paid off home.

This is because the lender had a lien on the home meaning that the lender could legally take ownership of the home through foreclosure if you failed to make your mortgage payments. Web Homeowners insurance protects the borrower aka homeowner whereas mortgage insurance protects the lender. Web You can generally avoid paying for mortgage insurance if you make at least a 20 down payment when you buy a home.

Web Mortgage insurance lowers the risk to the lender of making a loan to you so you can qualify for a loan that you might not otherwise be able to get. Web Unlike car insurance which is required by law homeowners insurance is not. Whereas homeowners insurance is a key requirement for all mortgage applicants mortgage insurance isnt always required.

Typically borrowers making a down payment of less than 20 percent of the purchase price of the home will need to pay for mortgage insurance. Most lenders require private mortgage insurance PMI if you put down less than 20. Do i really need home insurance.

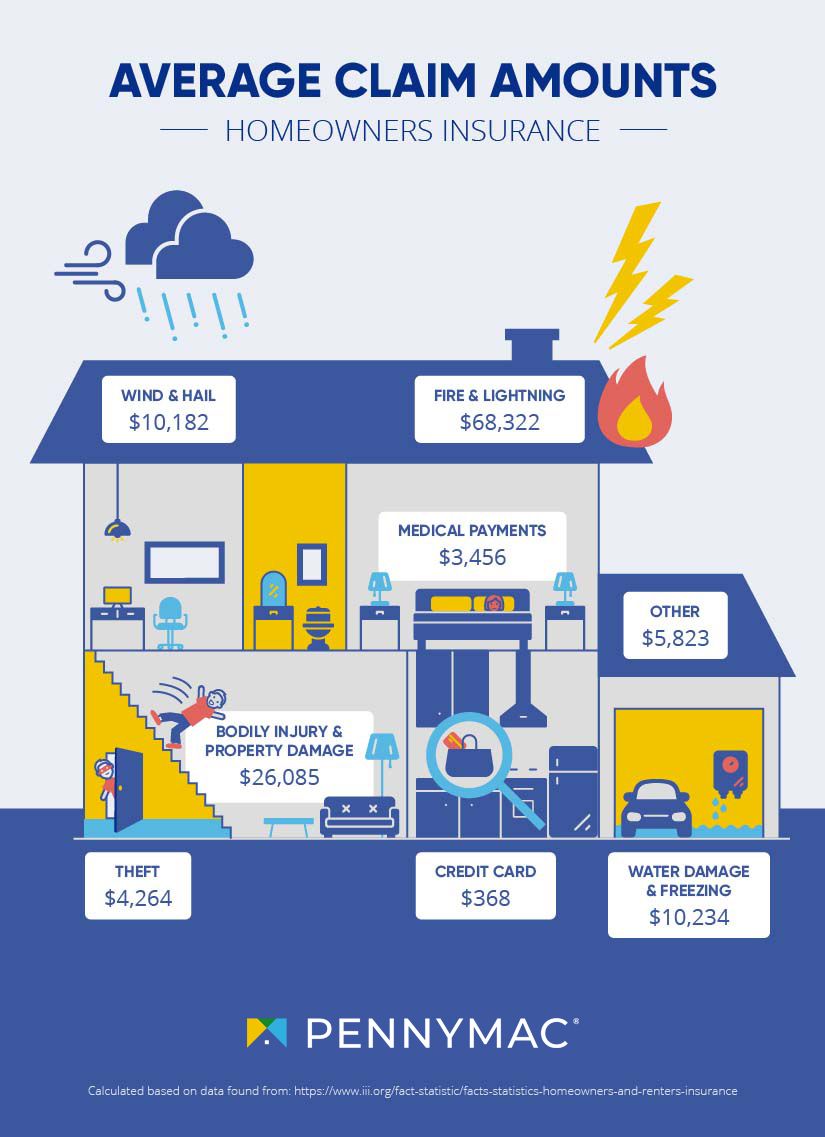

Web Homeowners insurance protects the homeowner the house and the property therein. It covers the repair or replacement of stolen or damaged belongings. During the repair of your home temporary living expenses will be paid.

Insurance on a house. Your mortgage lender is kind of a joint homeowner with you. Thats what the mortgage company cares about getting paid if your house burns down.

There are also some lenders and government programs that offer mortgages with lower down payments and no mortgage insurance requirement although they may be more expensive in other ways. Web As a homeowner you probably had to initially get your homeowners insurance policy as a requirement when you got your mortgage. 20 of the dwelling is covered.

Homeowners property coverage can help protect against the potentially devastating costs to rebuild or replace your property after damaging events like fire lightening and windstorms. Web no mortgage home insurance. Web Do you always need mortgage insurance.

Web Lender requirements differ. In exchange for these better terms the. Typically borrowers making a down payment of less than 20 of the purchase price of the home will need to pay for mortgage insurance.

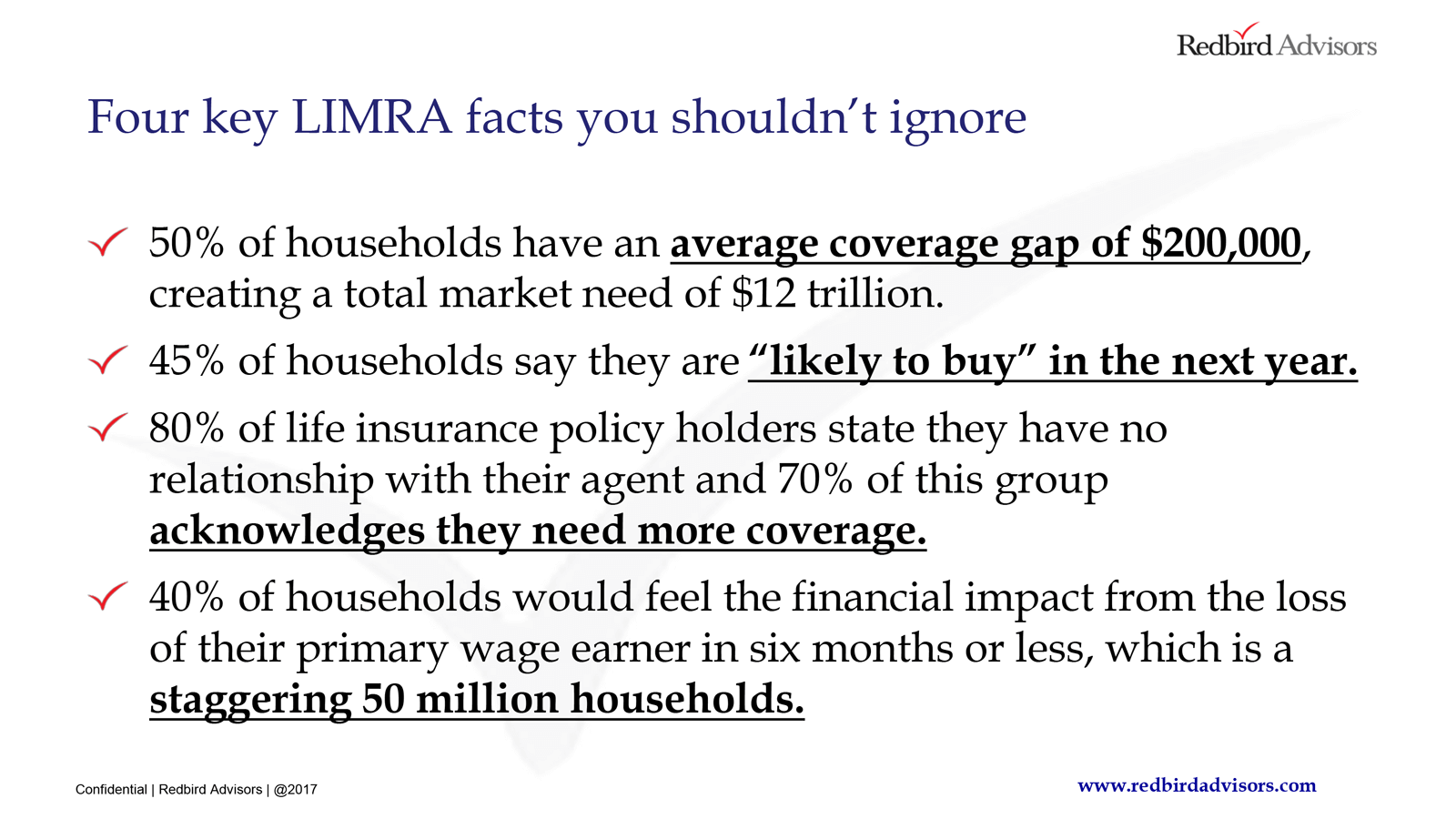

Web Mortgage insurance can help homebuyers get an affordable competitive interest rate and more easily qualify for a loan with a down payment as low as 3. Web Not only do you need to have homeowners insurance but the new lender will want to see that they are listed as the mortgagee on the new policy rather than your old lender. Most FHA home loans require an.

Is home insurance less if you own your house. At this point your old lender will receive notice that they have been removed from the policy as the mortgagee. Web FHA mortgage insurance premium MIP FHA loans feature minimum down payments as low as 35 and have easier credit qualifications than with conventional loans.

Web Coverage of 10 of dwellings. Think of it this way.

K1tbb P10j3a8m

![]()

Excel Expense Tracker Manage Create Expense Tracker In Excel

How To Sell Mortgage Protection Insurance And Make Six Figures

Four Major Action Groups Launched To Find New Ways To Tackle The Uk Housing Crisis

Mortgage Insurance How To Get The Best Coverage Bensol

What Is Homeowners Insurance And What Does It Cover Pennymac

What S The Difference Between Homeowners Insurance And Mortgage Insurance Travelers Insurance

:max_bytes(150000):strip_icc()/Reviewing-costs-of-private-mortgage-insurance-and-alternative-options-589043583df78caebcaecb69.jpg)

Homeowners Insurance Vs Mortgage Insurance

Mortgage Insurance Vs Home Insurance What S The Difference Bankrate

18510 Sand Rd Fulton Il 61252 Mls 11714778 Zillow

56 Insurance Wordpress Themes 2023 S Best Wp Templates For Insurance Agency Company

Mortgage Insurance Vs Home Insurance Valuepenguin

Term Life Insurance Canada Rbc Insurance

How Much Homeowners Insurance Does A Lender Require

2020 Millennial Home Buyer Report Clever Real Estate

How Much Homeowners Insurance Does A Lender Require

How Are Homeowners Insurance And Mortgage Insurance Different Experian